how much federal income tax comes out of paycheck

How Your Louisiana Paycheck Works. You pay the tax on only the first 147000 of.

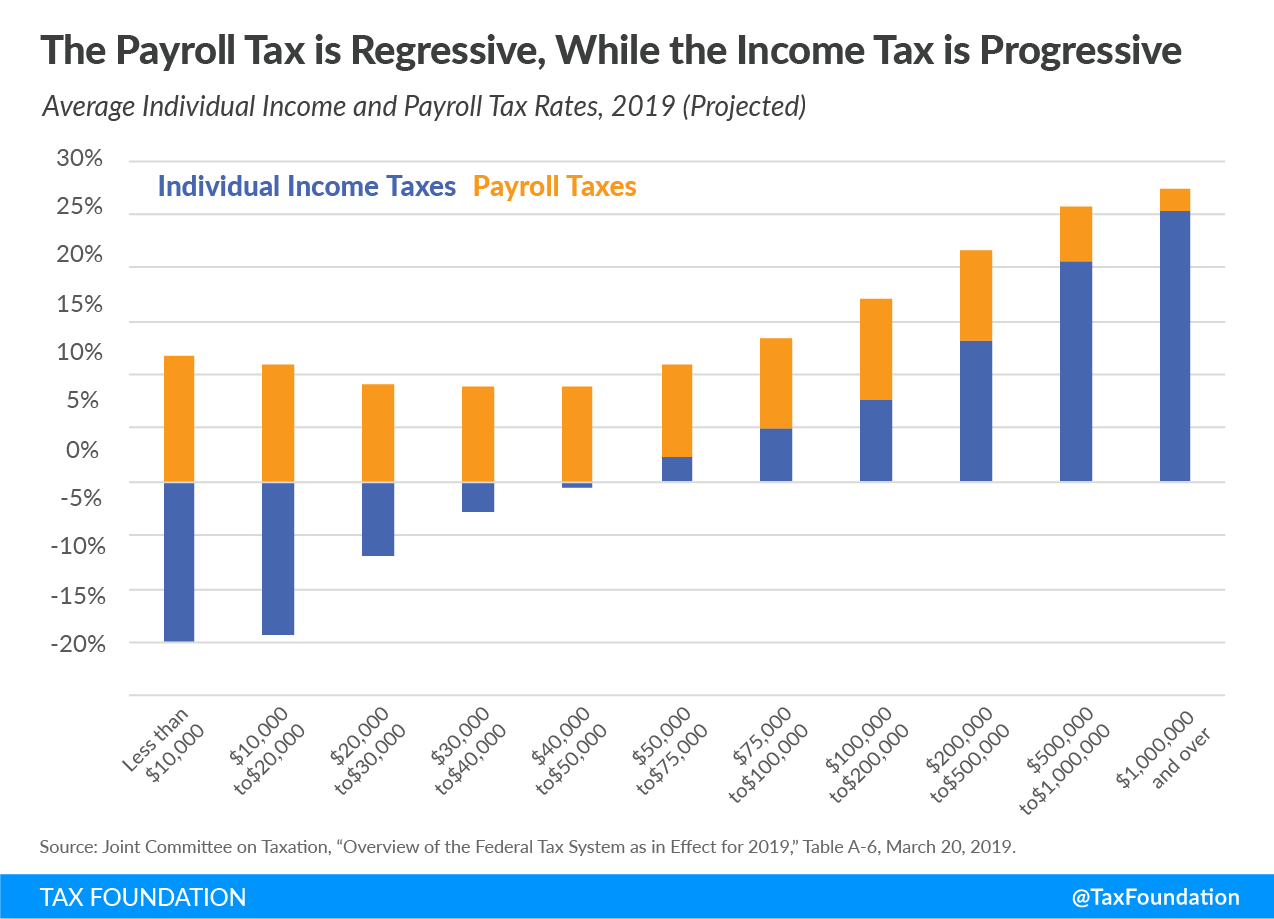

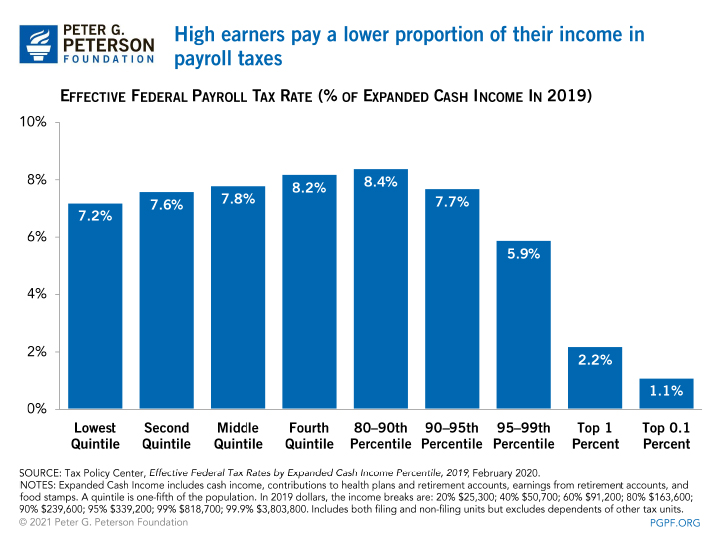

Most Americans Pay More In Payroll Taxes Than In Income Taxes

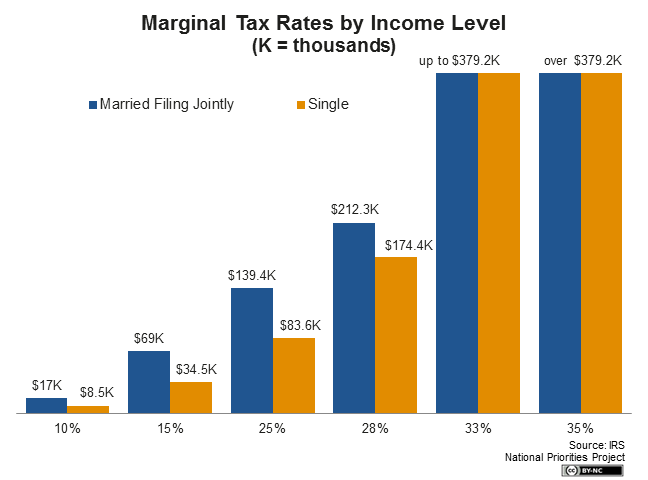

How much federal tax is taken out of your paycheck will also be determined by your tax bracket the more income you earn the higher percentage tax bracket you might.

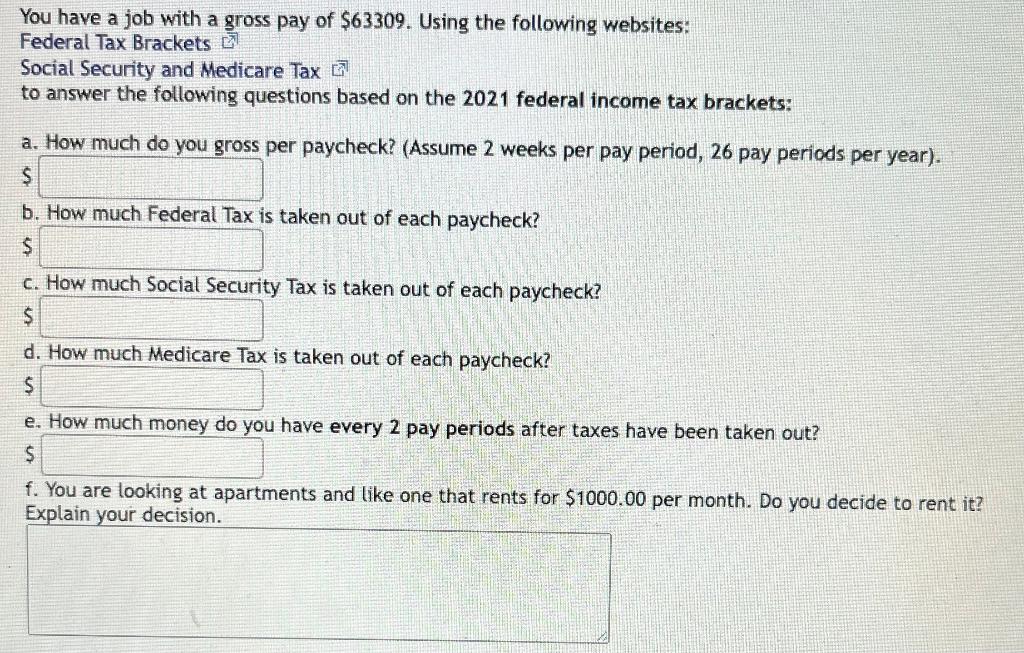

. Next up is federal income tax withholding. The Federal Income Tax is a tax that the IRS Internal Revenue Services withholds from your paycheck. For a single filer the first 9875 you earn is taxed at 10.

Federal income taxes are paid in tiers. The next 30249 you earnthe amount from 9876 to 40125is taxed at 15. See how your refund take-home pay or tax due are affected by withholding amount.

This tax will apply to any form of earning that sums up your income. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Ad Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider.

The only way you can get around this is if your income is very low. Federal income taxes are paid in tiers. Each employer withholds 62 of your gross income for Social.

Taxes Taken Out Of Paycheck Everything You Need To Know from. Estimate your federal income tax withholding. The amount withheld per paycheck.

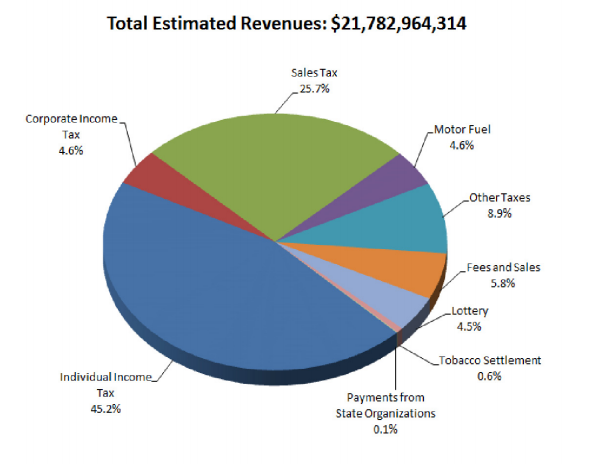

Some states follow the federal tax year some. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. A health savings account HSA or a.

Use this tool to. To do a Paycheck Checkup to make sure they have the right amount of. The state tax year is also 12 months but it differs from state to state.

A Paycheck Checkup can help you see if youre withholding the right amount of tax from your paycheck. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. What is the percentage that is taken out of a paycheck.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Discover Helpful Information and Resources on Taxes From AARP. See where that hard-earned money goes - Federal Income Tax Social Security and.

If you earn at least a specified amount for at least 40 quarters you can get Social Security benefits when you retire. The current rate for Medicare is 145 for the employer and 145 for. Your employer withholds a 62 Social.

The federal government collects your income tax payments. How to calculate Federal Tax based on your Weekly Income. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

Ad See Whats Been Adjusted for Income Tax Brackets in 2022 vs. How It Works. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

For a single filer the first 9875 you earn is taxed at 10. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The social security and medicare taxes come to 7650 for a total of 29650.

How Do I Know If I Am Exempt From Federal Withholding

Your Paycheck Tax Withholdings And Payroll Deductions Explained

You Have A Job With A Gross Pay Of 63309 Chegg Com

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

If I Live In Georgia How Much Of My Paycheck Goes To Lazy People Who Won T Get A Job By Glenn Stovall Medium

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Paycheck Calculator Online For Per Pay Period Create W 4

If My Job Did Not Take Out Federal Income Taxes Does That Mean I Pay

Who Owns Your Paycheck Life And My Finances

Payroll Taxes What Are They And What Do They Fund

Are Federal And State Taxes Withheld As A Percentage Of Your Pay In The Us Quora

Employee Social Security Tax Deferral Repayment Process

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Understanding Your W 4 Mission Money